When building a robust investment portfolio, one of the first questions you’ll face is whether to adopt an active or passive investment strategy. Each approach has its merits and drawbacks, and the best choice often depends on your financial goals, risk tolerance, and investment horizon. Consulting with a financial advisor, financial consultant, or wealth planner can help you make an informed decision tailored to your specific needs.

Understanding Active Investment Strategies

Active investment involves a hands-on approach where a portfolio manager or investor makes frequent decisions about buying and selling assets. The goal is to outperform the market or a specific benchmark index.

Key Features of Active Investing:

Professional Management: Typically overseen by experienced fund managers or a financial consultant who actively researches and selects investments.

Flexibility: Ability to quickly respond to market changes and take advantage of short-term opportunities.

Higher Costs: Management fees and transaction costs tend to be higher due to frequent trading.

Who Should Consider Active Investing?

Investors seeking above-average returns and willing to accept higher risk.

Those with a shorter investment horizon who aim to capitalize on market trends.

Individuals working closely with a financial advisor or wealth planner who can provide expert guidance.

Understanding Passive Investment Strategies

Passive investment, on the other hand, involves a more hands-off approach. The strategy focuses on replicating the performance of a specific index, such as the S&P 500, rather than attempting to beat it.

Key Features of Passive Investing:

Lower Costs: Since there is minimal buying and selling, passive strategies usually come with lower expense ratios.

Long-Term Focus: Designed for investors with a buy-and-hold mentality, aiming for steady growth over time.

Transparency: Passive funds, such as index funds or ETFs, often have clearly defined objectives and holdings.

Who Should Consider Passive Investing?

Investors looking for a cost-effective and low-maintenance approach.

Those with a long-term investment horizon and moderate risk tolerance.

Individuals who prefer simplicity and broad market exposure.

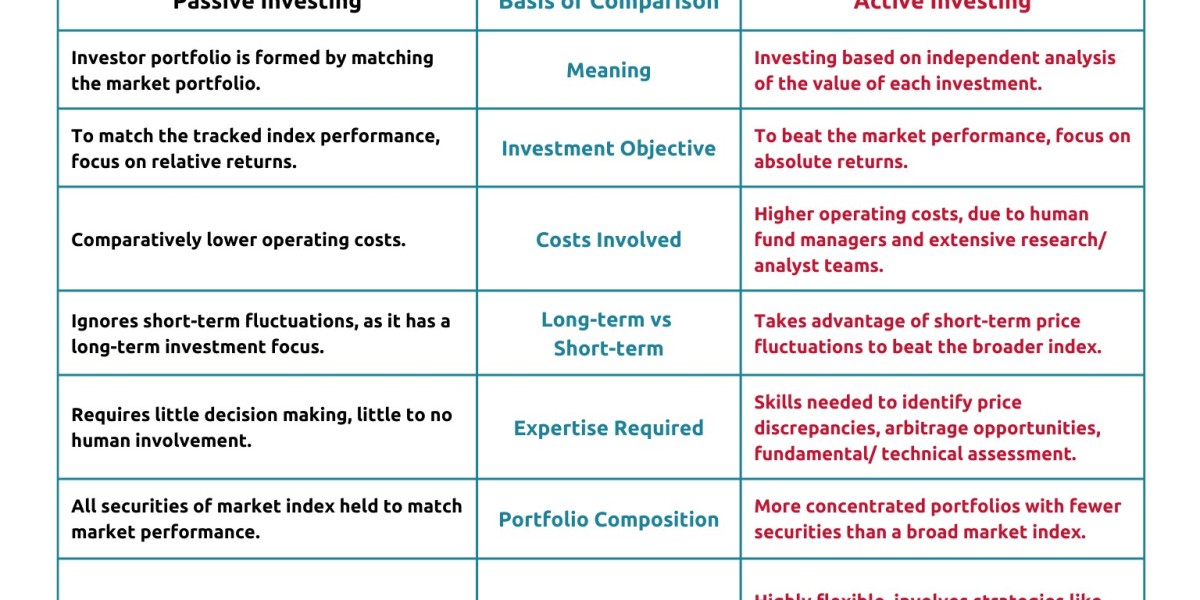

Comparing Active and Passive Strategies

| Criteria | Active Investing | Passive Investing |

|---|---|---|

| Goal | Beat the market | Match market performance |

| Cost | Higher (management and trading fees) | Lower (minimal trading costs) |

| Flexibility | High | Low |

| Risk | Higher | Moderate |

| Time Commitment | Requires monitoring | Minimal |

Factors to Consider When Choosing

Financial Goals: Are you looking for aggressive growth, steady income, or capital preservation?

Risk Tolerance: Can you handle market volatility and potential losses, or do you prefer stability?

Time Horizon: Do you have a short-term goal, or are you investing for retirement decades away?

Expert Guidance: A financial consultant or wealth planner can help clarify these factors and recommend a strategy.

The Hybrid Approach

Many investors find that a combination of active and passive strategies works best. For example, you might allocate a portion of your portfolio to actively managed funds for potential high returns while keeping the rest in low-cost index funds for stability and diversification. A financial advisor can help you strike the right balance.

Final Thoughts

Choosing between active and passive investment strategies is not a one-size-fits-all decision. It’s essential to consider your financial situation, investment goals, and risk tolerance. Consulting a financial advisor, financial consultant, or wealth planner can provide personalized advice and ensure that your investment strategy aligns with your long-term objectives. Whether you choose active, passive, or a mix of both, the key is to remain disciplined and focused on your goals.

Naijamatta is a social networking site,

download Naijamatta from Google play store or visit www.naijamatta.com to register. You can post, comment, do voice and video call, join and open group, go live etc. Join Naijamatta family, the Green app.

Click To Download