Fintech Lending Market Overview:

The Fintech Lending Market was valued at USD 332.56 billion in 2022 and is projected to experience steady growth in the coming years. The market is expected to rise from USD 348.09 billion in 2023 to USD 525.0 billion by 2032, with a compound annual growth rate (CAGR) of 4.67% during the forecast period from 2024 to 2032. The rapid adoption of digital technologies, combined with the increasing demand for convenient and accessible financial services, are key drivers propelling the fintech lending industry's growth.

Understanding Fintech Lending

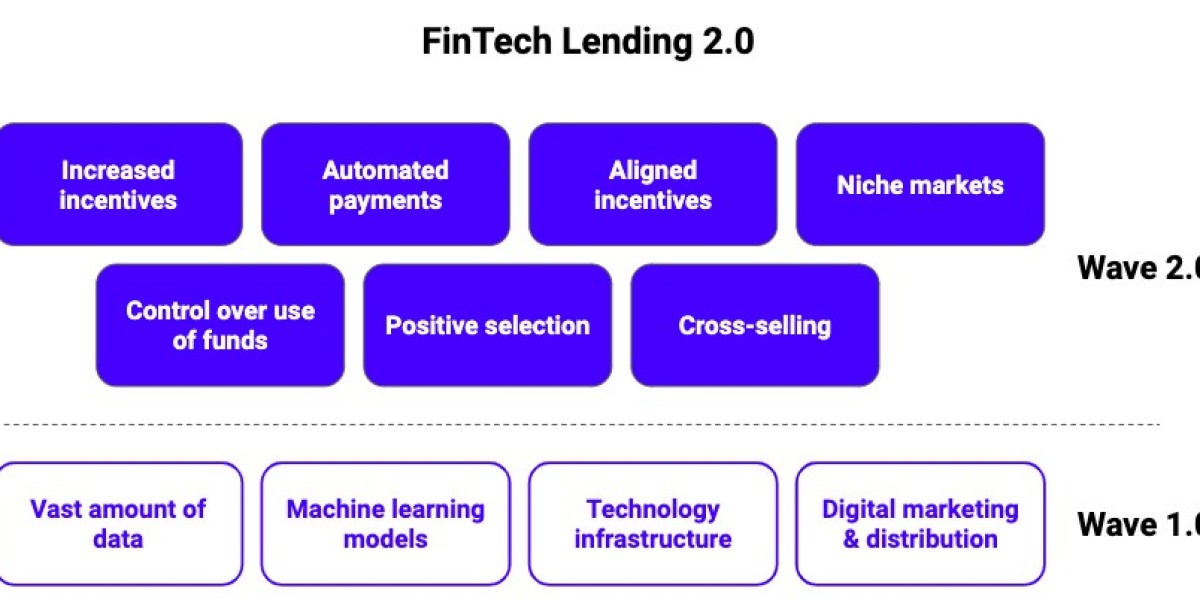

Fintech lending refers to the use of technology to streamline and enhance traditional lending processes. By leveraging digital platforms, artificial intelligence, data analytics, and automation, fintech companies offer faster, more efficient lending services compared to traditional banks. This can include personal loans, business loans, peer-to-peer lending, and mortgage lending, all facilitated through online platforms.

The key difference between fintech lenders and traditional financial institutions lies in their ability to use alternative data, such as social media activity or online transactions, to assess creditworthiness. This approach has democratized access to credit, making loans more available to individuals and businesses that may have been underserved by traditional banks.

Request For Sample Report PDF - https://www.marketresearchfuture.com/sample_request/22833

Market Drivers

Digital Transformation in Financial Services: The ongoing digital revolution has transformed how financial services are offered and consumed. Fintech companies have capitalized on this trend by offering user-friendly platforms that allow borrowers to access loans online without the need for physical paperwork or lengthy approval processes. This shift has greatly contributed to the growing popularity of fintech lending.

Increased Accessibility: One of the main reasons fintech lending is expanding is the increased accessibility it offers to borrowers. With the use of mobile apps, artificial intelligence (AI), and big data analytics, fintech lenders can quickly assess a borrower's creditworthiness and provide loans with minimal hassle. This accessibility, coupled with quicker loan approvals and disbursements, has made fintech lending a preferred option for many consumers and businesses.

Rise of Peer-to-Peer (P2P) Lending: Peer-to-peer lending platforms have gained significant traction in the fintech lending space. These platforms connect borrowers directly with individual lenders, eliminating the need for a traditional financial institution to act as an intermediary. P2P lending has grown in popularity, especially among small businesses and individual borrowers looking for alternative funding sources.

Underbanked Populations: A significant portion of the global population, particularly in emerging markets, is underserved by traditional banks. Fintech lending platforms cater to these underbanked or unbanked populations by providing access to financial services that may have been otherwise unavailable. This has opened up new avenues for growth in regions like Asia-Pacific, Africa, and Latin America, where fintech adoption is accelerating.

Key Challenges

Despite the positive growth prospects, the fintech lending market faces several challenges:

Regulatory Hurdles: The fintech lending industry operates in a highly regulated environment. Governments and financial regulators around the world are increasingly scrutinizing fintech companies, particularly concerning data privacy, security, and consumer protection. As a result, fintech companies must navigate complex regulations that vary by region, which can hinder market expansion.

Data Security Concerns: Since fintech lending relies heavily on digital platforms and the use of customer data, ensuring data security is a significant challenge. Cybersecurity breaches, data theft, and fraud pose risks to the credibility of fintech lenders. Addressing these concerns and maintaining trust in digital lending platforms will be crucial for the sustained growth of the industry.

Competition from Traditional Banks: Traditional financial institutions have also begun embracing digital technologies, launching their own fintech services to compete with fintech lenders. This increased competition can impact the market share of fintech companies, especially if traditional banks leverage their established brand reputation and customer trust to offer competitive digital lending products.

Market Opportunities

Expansion in Emerging Markets: Emerging markets represent a significant growth opportunity for the fintech lending industry. In regions such as Southeast Asia, Latin America, and Africa, fintech lending has the potential to address the credit gap for individuals and businesses that lack access to traditional banking services. As smartphone and internet penetration increase in these regions, the demand for fintech lending is expected to rise.

Adoption of AI and Machine Learning: Artificial intelligence (AI) and machine learning (ML) technologies have revolutionized the lending industry by automating loan underwriting processes and improving risk assessment. Fintech companies that invest in AI and ML will be better positioned to offer more personalized and efficient lending solutions, driving market growth.

Partnerships with Financial Institutions: Many traditional banks are forming partnerships with fintech lenders to expand their digital lending capabilities. These collaborations allow banks to leverage fintech innovation while providing fintech companies with access to a broader customer base. As a result, such partnerships are expected to create new growth avenues for the fintech lending industry.

Conclusion

The Fintech Lending Market is on a steady growth trajectory, with the market size expected to reach USD 525.0 billion by 2032. The industry is being driven by digital transformation in financial services, the rising demand for accessible credit, and the adoption of innovative technologies like AI and machine learning. While challenges such as regulatory scrutiny and data security remain, the expansion into emerging markets and partnerships with traditional financial institutions provide ample growth opportunities.

As fintech lenders continue to disrupt the traditional lending landscape, they are reshaping how consumers and businesses access credit, offering faster, more efficient, and more inclusive lending solutions.

Naijamatta is a social networking site,

download Naijamatta from Google play store or visit www.naijamatta.com to register. You can post, comment, do voice and video call, join and open group, go live etc. Join Naijamatta family, the Green app.

Click To Download